After a work session lasting just over an hour Monday night to discuss the City of Great Bend’s 2024 budget, the Great Bend City Council gave a tacit nod to the proposed $31,867,000 spending plan.

“This is a $1,510,000 increase from 2023,” Interim Administrator Logan Burns said. Inflation, wages and a 10% increase in health insurance costs contributed to jump.

“We are presenting a budget that remains revenue neutral,” he said. The budget ($27,031,000 from property taxes, with the balance from end-of-2023 cash transfers) is supported by a mill rate of 45.202.

One mill is one dollar per $1,000 of assessed value. For Great Bend in 2024, each mill is worth $128,753.

This is lower than the 52.52 mill rate in 2023 and does not exceed the Revenue Neutral Rate (RNR), Burns said. The RNR is the tax rate that would generate the same total property tax dollars for the city as the previous year using the current year’s assessed valuation.

Even so, Burns recommended the city proceed with a RNR hearing. “This will protect the dollar amount the city will receive upon the final valuation.”

The 2024 valuation is estimated at $128,753,482, up over $16 million from last year. But, this is based on preliminary numbers with the final total not available until November.

Monday’s meeting was only the first step in the budget process.

So, when the council holds its next regular meeting this coming Monday, it will vote to exceed the RNR. The city will then notify the Barton County Clerk’s Office of its intention and publish the budget Aug. 26 in the Great Bend Tribune.

The RNR hearing is set for the Sept. 5 meeting, just prior to the regular budget hearing. It will be at that meeting the council ultimately approves the budget.

The plan also includes $225,006,797 in operating revenue. Of that, 28% comes from sales taxes and 23% from property taxes, with the rest from sewer and water fees, and other sources (other fees, permits, facility rentals, franchise fees, etc.).

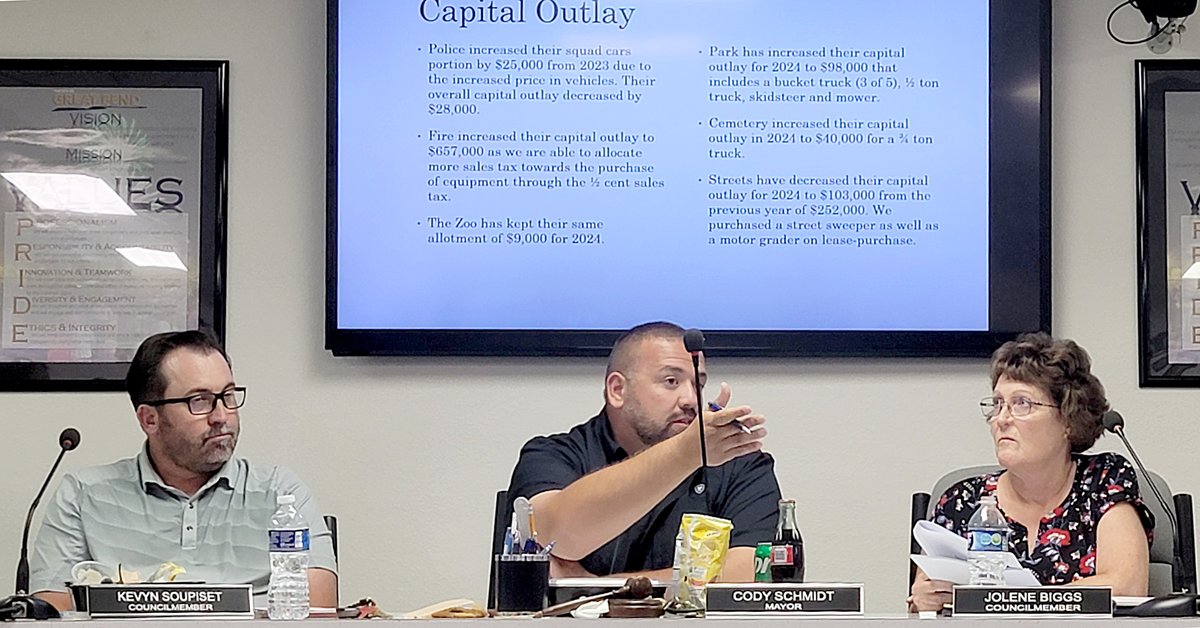

Of the expenditures, capital improvements/equipment, Police Department and Fire Department account for around 30% of the budget. Water and sewer, parks and streets make up another roughly 27%, and the remainder goes to the Events Center, cemetery, administration, staff benefits and other agencies.

A brief walk-through

Burns took the council on a tour of the proposed budget. He highlighted key areas, including budget components like a cost-of-living raise for staff, an increase in insurance premiums, priority projects, vehicle purchases and how the city plans to fund outside agencies.

Council members picked through the proposal, making minor tweaks to it.

Some budget highlights:

• With the new adjusted fee schedule, fee revenues have increased.

• Inspections and Code Enforcement: Moving these departments into what is the current Police Station after the police move to the new Justice Center was discussed.

• Staffing: There is the possibly a need to hire a full-time custodian for the new Justice Center at an estimated salary of $55,000. This position could be split between multiple city buildings.

• Water and sewer rates: These will see a 3-3.5% increase. An ordinance passed in 2020 has helped increase revenue, and the new automated meter reading system could increase it even more, so future increases may not be necessary.

• Health insurance: There will be a 10% increase.

• Wages: The budget accounts for adjusting the minimum starting salary for city staff to $15.50 per hour and a 50-cent raise for employees already above the minimum.

• The city’s fleet: Several departments indicated the need for new vehicles, ranging from pickups to skid loaders to bucket trucks.

Outside agencies

These are entities that are not officially a part of the city, but serve residents and have historically received financial support.

The following amounts were included in the budget:

• Volunteers in Action of Central Kansas/RSVP: $1,950 for the medical transportation program, 65% of the $3,000 requested since 65% of the rides given are for Great Bend residents.

• Barton County Fair: $5,000. This is the same as last year, although $10,000 was requested.

• Barton County Historical Society: $10,000. They had requested $20,000.

• Golden Belt Humane Society: Funding at $107,500, a 2.5% increase from last year, but less than the 5% requested. The city is under contract with the society.

• Commission on Aging: $225,795. This reflects the $10,000 to help the agency purchase a new bus, but is less than the over $250,000 sought.

• Great Bend Economic Development Inc.: $250,000, as requested and is an amount being matched by Barton County. There were questions over the total, but in the end, the council saw the need to keep the funding.

• Great Bend Public Library: $650,000, same as last year. They had requested a $1,000 increase.

The library will still see an $11,500 increase in tax revenue, qualifying it to apply for a state grant.

Looking to the future

“As a business man, I’m seeing things skyrocket,” said Ward 1 Councilman Alan Moeder, noting it may not always be prudent to hold the budget line. “We can’t get this city in trouble five years down the road.”

He said department heads are being “pushed into a corner” to stand pat on expenses. He polled the department heads present who indicated they were doing OK for now, although there may come a time when there is a need to spend more.

“This is fine for this year, but we may want to look at it next year,” he said. He said he would rather have reserves on hand than have to issue large bonds for large projects.