Affordable Care Act questions addressed

Editor’s note: Monday, March 31, is the deadline to sign up for health insurance under the Affordable Care Act open enrollment period. The following piece was prepared by Debra Wood, Central Kansas Extension District family resource management agent.

Are you covered by health insurance? Health insurance is a good idea – it’s good for your finances and for your health. It is also now a legal requirement for most Americans, and help with paying for health insurance is now available to most people with moderate incomes.

You’re already covered if you have Medicare, Kan-Care (formerly Medicaid and Healthwave for children), any job based health plan, COBRA, retiree coverage, Tri-Care, VA health coverage, or some other types of health coverage. It is especially important for those on Medicare to understand the Marketplace will have no effect on their Medicare coverage. In fact, it is illegal for someone to sell you a Marketplace policy if they know you have Medicare.

Many people who do not have other offers of coverage are eligible for help with paying for health insurance premiums, but only if they enroll through the new Health Insurance Marketplace.

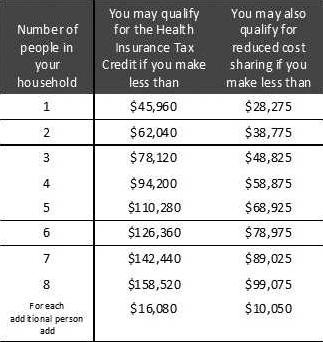

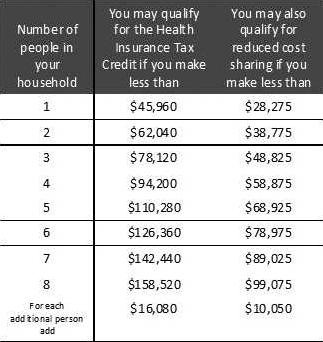

The Health Insurance Marketplace helps uninsured people find health coverage. Applying and enrolling through the Marketplace, at www.healthcare.gov, lets consumers find out if they qualify for a premium tax credit to help pay the health insurance premiums for a plan purchased through the Marketplace, and cost sharing reductions which can help to lower out-of-pocket costs. [See table below]

All plans in the Marketplace cover essential health benefits, pre-existing conditions, and preventive care. No one can be denied coverage due to a pre-existing condition.

If a consumer has access to insurance through an employer, the Marketplace can be used to comparison shop and purchase insurance, but the family may not be eligible for the Premium Tax Credit depending on whether their employer coverage meets certain standards.

Most people must have health coverage in 2014 or pay a fee. If you don’t have coverage in 2014, and don’t qualify for an exemption, you’ll have to pay a penalty of $95 per adult, $47.50 per child, or 1 percent of your income, whichever is higher. Exemptions from the individual responsibility payment are available in certain situations.

One important thing to note is that while policies cannot be cancelled because of health conditions, they may be cancelled if premiums are not paid on time. In this situation the family may be required to wait until the next open enrollment period to enroll again.

Consumer Reports has created a tool to help determine if you qualify for premium tax credits. This is located at https://www.healthtaxcredittool.org/. In addition to the health insurance literacy information on the Healthcare.gov website, your local extension office has educational resources available, as does the Kansas Insurance Department site at www.insureks.org. This site also includes a list of Navigators and assistors in addition to plan information, and a list of locally scheduled presentations including here in the Salina area. The deadline to enroll for coverage this year is March 31. A special enrollment period will also be available within 60 days of a qualifying event during the year.

KANSAS CITY, Kan. — With the deadline fast approaching to get health coverage this year through the Affordable Care Act’s marketplace plans, a final push is on across Kansas, Missouri and other states to get people signed up.

“We have stepped up efforts with our outreach activities. Our navigators have jam-packed their schedules, getting appointments made to get people enrolled,” said Katrina McGivern, communications coordinator for the Kansas Association for the Medically Underserved, one of the Kansas groups given federal grant dollars to help get people enrolled. The association represents Kansas’ various safety net clinics.

KAMU already had billboard advertisements for the Obamacare marketplace up in various parts of the state, but this past weekend also began airing ads in movie theaters. Radio and TV ads also have been airing in the various markets.

The last day of open enrollment is March 31 and most involved with it report that the pace has picked up considerably since the marketplace’s slow start in October 2013. Starting this year, most people who don’t have health insurance but can afford it will face penalties.

‘Starting to realize’

“I think people are starting to realize the deadline is coming. We’re seeing a lot of people who have never had insurance before. They don’t know about co-pays and deductibles. We’re really working with them from square one,” said Misty Kruger of the Shawnee County Health Agency in Topeka.

The agency hired certified navigators and counselors to help people get enrolled and stationed the workers at the public library, a popular community gathering spot, with hours that extend into the evenings and weekends.

Earlier this month in Kansas City, Kan., organizers held a two-day health fair as part of efforts to get the word out.

Salvador Lopez, an Excelsior Springs, Mo. farm worker, was among those who attended the event. He came with his wife and two daughters.

He said he would like health insurance so he could afford diabetes medicine. The coverage also could help his wife, who said she wasn’t feeling well as she had her blood pressure checked.

Lopez said Medicaid already covers his daughters and he was optimistic he would be able to find a plan he could afford through the new marketplace.

“It’s going to help me a lot,” he said.

“I would say the majority of people that we see have no idea what health insurance is, have never had it,” said Pam Seymour, executive director of Shepherd’s Center Central. The nonprofit has two locations in Kansas City, Mo., and has more than a dozen trained workers to help individuals navigate the enrollment process using the federal website.

Surge expected

The U.S. Department of Health and Human Services reported last that 4.2 million people nationwide had purchased exchange plans through the end of February. The Congressional Budget Office had originally projected that 7 million people would enroll in private plans in the first year of the marketplace. Last month it revised that downward to 6 million.

The latest numbers from HHS included about 104,000 people who were signed up in Missouri and Kansas. According to federal estimates, about 1.1 million people in the two states are uninsured and eligible to participate in the exchange. Nationally, the number of uninsured people in 2012 was estimated at about 47 million.

The Congressional Budget Office estimates that about 6 million people will get coverage through the Obamacare marketplaces this year, about 20 percent less than originally projected.

But officials said they are expecting there will be a flurry of enrollments at or near the deadline.

“What we are finding,” HHS Secretary Kathleen Sebelius said with the release of the new enrollment numbers, “is that as more Americans learn just how affordable marketplace insurance can be, more are signing up.”

A department spokeswoman said agency officials were “busy preparing to handle an anticipated surge in enrollment as we approach the end of March.”

HHS officials said they had hired an additional 2,000 workers for the department’s help line – bringing the total to about 14,000 representatives.

Drafters of the Affordable Care Act intended the health insurance marketplaces to operate much like online systems that allow shoppers to compare prices on airline tickets or hotel rooms. The idea behind that was that competition among plans would yield the best deals for consumers.

There also was the assumption that the marketplace could give individuals the clout of being part of a large group similar to people enrolled in a large, employer-based plan.

Resistance

The health-reform law gave states the option of establishing their own marketplace or participating in a federally run exchange.

According to the Kaiser Family Foundation, 17 states have their own exchanges. The remaining states are relying on the federal marketplace or created a hybrid federal-state operation.

In many instances, as in Missouri and Kansas, the decision not to establish a state exchange stemmed from conservative Republican and/or voter opposition to Obamacare.

In November 2012, Missouri voters approved a proposition barring the governor or any state agency from helping establish an exchange without legislative or voter approval.

Kansas Gov. Sam Brownback, a conservative Republican who ran for office campaigning against the health reform law, rejected $31.5 million in federal grant money that would have allowed the state to build its own exchange. He also rejected a plan that would have let the state partner with the federal government on a marketplace, opting instead for one run solely by the national government.

Final push

At the Shepherd’s Center in Kansas City, Seymour said, “everybody is ready and up to the challenge of getting these last-minute people enrolled. We are going to pull out all the stops and do whatever we need to do.”

Shepherd’s Center is among the various groups in Missouri and Kansas that are working to inform people that time is running out to buy insurance for 2014 through the marketplace. The next enrollment period starts in November.

Among the initiatives in the Kansas City metro area are Enroll Wyandotte, the coalition that sponsored the recent health fair, and CoverKC, a $700,000 effort bankrolled by the Health Care Foundation of Greater Kansas City.

The St. Louis-based Missouri Foundation for Health has a statewide project called Cover Missouri.

In Kansas, the state insurance department is working with KAMU and other outside organizations to spread the word about the Obamacare health plans.

Various activities

Here are some of the efforts to date and plans for the next couple of weeks:

• Cover Missouri: Has helped enroll about 68,000 Missourians for health insurance through the Affordable Care Act, said Ryan Barker, health policy vice president at the Missouri Foundation for Health. That total includes some people who turned out to be eligible for Medicaid. With a multimedia campaign on tap, Barker said he hopes the effort can have 130,000 people enrolled by the end of the month.

• Among KAMU’s efforts is a text messaging campaign. And various KAMU members are running their own ad campaigns and enrollment events, including an “enrollment blitz” scheduled from 10 a.m. to 5 p.m. at the Center for Health and Wellness in Wichita. The Wyandotte Health Department will be taking enrollments from 9 a.m. to 5 p.m. on the deadline day.

• CoverKC: Since January, workers have knocked on more than 35,000 doors in the urban cores of Kansas City, Mo., and Kansas City, Kan., according to Jessica Hembree, program and policy officer for the Health Care Foundation of Greater Kansas City. Organizers said they hope to have knocked at 70,000 doors by the end of this month, supplemented by mail, telephone and digital marketing.

• Enroll Wyandotte workers aim to have reached about 18,000 residents by the end of the month, said Jerry Jones, executive director of the Community Health Council of Wyandotte County. By the end of the next enrollment period, which ends in mid-January, Jones said the goal is to have 12,000 previously uninsured county residents enrolled in plans through the marketplace.

Enrollment workers said the federal website is working much better than it did last fall.

Field workers said it still can take upwards of two, three or five hours to enroll, if the case is complex, but that they are cautiously optimistic the anticipated surge of sign-ups in the next couple of weeks will not lead to another meltdown.

“We hope the process works better,” said Linda Sheppard, special counsel and director of health care policy and analysis at the Kansas Department of Insurance. “I assume it will. We will see what happens.”