As a real estate agent, Nancy Lynn Jarvis was always on the lookout for that killer deal.

Now, at an age where some choose not to work, Jarvis is busy arranging murders — but only on paper.

Jarvis, 66, of Santa Cruz, California, is the author of seven books — five of which are murder mysteries featuring a real estate agent as the protagonist. As she herself admits, she came late to the writer’s muse, having only published her first book in 2008.

Her literary path may be somewhat unusual, but the timeline is becoming commonplace. A growing number of older Americans are chucking the notion of a “conventional” retirement and working past the age when others eagerly mothball their business suits and briefcases.

But working well into your retirement years isn’t for everyone. To do so successfully requires some introspection and a clear understanding of why work in later years can beat retirement.

Still on the job

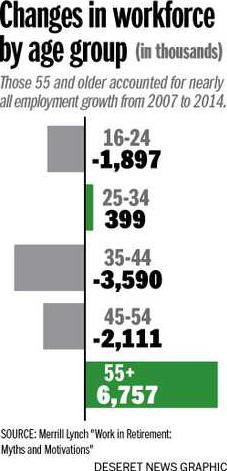

Older Americans are shifting the demographics of the labor force. According to the 2014 study “Work in Retirement: Myths and Motivations” by Merrill Lynch and research firm Age Wave, more than seven of 10 people approaching retirement said they want to work past average retirement age of 64, as of 2010. Perhaps even more telling, the report suggests that it will be increasingly unusual for older people not to work during this period in their lives.

Employment statistics support that. The Bureau of Labor Statistics found that 32.7 million people over the age of 55 were employed in September 2014 — up from 21.7 million 10 years ago. The BLS also projects that by 2022, 31.9 percent of those ages 65 to 74 will still be working.

The reasons are varied. For one thing, perception of older age has changed, resulting in what the Merrill study refers to as a “re-visioning of later life.” Additionally, increasing life expectancy — coupled with better overall health during those additional years — has made a longer working life more viable.

That carries both opportunity and pitfalls. While many older Americans find themselves looking at a longer lifespan than prior generations, they should also anticipate additional costs — in living expenses, health care and other financial outlays.

“Many are finding that they cannot afford to live the lifestyle they anticipated living prior to retiring,” said Art Koff, founder of RetiredBrains.com, an online retirement planning site. “They must find a way to earn additional revenue and continue to work — be it part-time, temporary or project-based.”

But financial necessity isn’t the sole driver — or necessarily the most powerful. For many, years of accumulated experience are simply too valuable to shelve prematurely.

“The most important thing for me was the intellectual stimulation that comes from interacting and continuing to learn from other people,” said Paul Dillon, 69, of Chicago, a retired accountant who opened a consulting business. “I had accumulated so much expertise and so many contacts that I decided to try something on my own.”

That also applies to Jarvis’ burgeoning literary career. Her real estate license having lapsed, Jarvis said, she became bored and began reading mystery novels — in particular, the works of Tony Hillerman, whose murder mysteries often feature Navajo tribal police in the Southwestern United States. Jarvis took the cue and began working on material with a similarly singular focus — in her case, the real estate industry.

“Writing for me really started out as a game,” she said. “But we printed 100 copies of the first book, and they all sold. So we printed 100 more. According to the reviews, I seemed to be able to create very realistic situations.”

To work or not?

However inspiring stories such as Jarvis’ might be, working past conventional retirement age shouldn’t be pursued without thought and planning.

For one thing, research has suggested that some retirees who plan on working longer don't end up actually doing so — often due to reasons outside of their control.

“It’s more likely that someone ends up retiring earlier than expected rather than later due to layoffs, family caregiving responsibilities, lack of continued employment opportunities and personal health reasons,” said Jamie Hopkins, associate director of the New York Life Center for Retirement Income.

And for those working past retirement purely for financial reasons, a 2011 report by the Society of Actuaries has this warning: Planning to work longer “may be a rationale for not saving and preparing.”

But if working past retirement appeals for reasons other than financial, taking stock of interests and abilities can provide a reliable roadmap for pursuing suitable and rewarding employment.

“People should take some time to sit down and really contemplate what they’re good at, what they’re not good at, what they really want to do and what they really don’t want to do,” said Dillon. “Any actions should be balanced by sufficient reflection.”

Koff recommends that would-be working retirees investigate any number of online job boards, such as CareerBuilder and Monster.com. There, they can get a sense of what jobs are available as well as their personal and professional capacity to effectively perform different kinds of work.

“I don’t believe that the great majority of people have the ability to evaluate their skills themselves or can figure out on their own the new career that is best for them,” he said.

Stay flexible

What ultimately proves most appealing will vary. Some retirees may simply stick with the sort of work they’ve pursued for much of their lives, although likely not in the same setting. The Society of Actuaries report found that half of employed retirees worked for new employers.

Others might find a slight twist on their work history particularly satisfying. Like Dillon’s consultancy and Jarvis’ novels, pursuing a different direction with a toehold to past experience can be both refreshing and less intimidating than taking on work or a career that’s completely new.

Still another option is starting a business in retirement. Here, the numbers are telling: Among entrepreneurs ages 20 to 64 who founded their first businesses in 2012, 23 percent were 55 or older, according to the Ewing Marion Kauffman Foundation. That’s the result of a confluence of several positive factors and circumstances — among them, years of experience and longer life expectancy, says Charles H. Matthews of the University of Cincinnati Center for Entrepreneurship Education and Research.

“If you’re thinking about pursuing a new venture startup post-retirement, build on your wisdom, tap your intellect, bring it to life with some savvy and implement from your experience, energy and effort,” he said.

Lastly, don’t consider a post retirement career choice as cast in stone. If something isn’t sufficiently satisfying or lucrative, opt for a Plan B. As Jarvis said: “I’m a big believer in trying something new every few years.”

Jeff Wuorio lives in Southern Maine where he covers personal finance and entrepreneurship. He may be reached at Jwuorio@yahoo.com, and his website is jeffwuorio.com.

Finding opportunities, avoiding pitfalls while working past retirement age