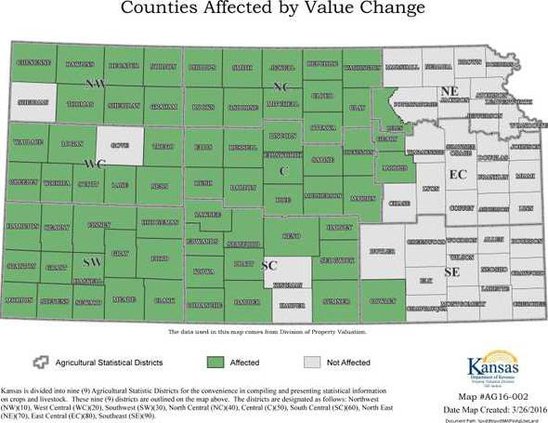

Agricultural land values in 66 Kansas counties, including all of the Golden Belt, may decrease slightly from property valuations recently sent out, depending on the property’s soil type.

Valuations on some property for tax year 2016 could decrease by as much as $3 an acre, due to a clerical error in Topeka. Because this is a decrease in property value, counties are not required to send out a second notice.

Barton County Appraiser Barb Esfeld said her office did send out nearly 2,000 corrected notices on April 18 for all land affected in Barton County. Values in Barton County only saw a decrease of $1-2 on some soil types. Approximately 85 percent of the county’s 4,505 parcels — 3,839 — were affected.

“The taxpayer deserves to have the correct figures,” Esfeld said, adding she got approval from the County Commission to mail the notices, at a cost of about $1,200.

Virtually all of the counties in the western two-third of the state are affected. The exceptions are Sherman, Gove, Kingman and Harper counties. Esfeld said she may be the only appraiser who opted to mail notices, but property owners with questions about their agricultural land value can contact their local county appraiser’s office.

The error was caught early. While valuation notices are sent out in March, values aren’t certified to the county clerks until June 15 and tax bills have not yet been mailed to property owners. The changes will be reflected in the 2016 tax bills.

There was a clerical error in the calculation provided to the state Property Valuation Division to determine some valuations which caused the mistake.

Most people won’t even notice the change, Esfeld said. On a parcel with a $20 decrease in valuation, the savings taxes would only be about 96 cents. But some will save more. Using an average mill levy, Barton County landowners will collectively save $25,500 over what they would have paid without the correction.

“Ag land had been going up for several years,” Esfeld noted. “Even with this decrease, it’s still up.”

Ag land values decrease slightly