Appraiser’s Office conducting residential, commercial re-inspections

Starting in June and running through September, Barton County Appraiser’s Office personnel will be conducting its annual re-inspection of real property, which includes residential, commercial and vacant properties, County Appraiser Barb Esfeld said.

Field appraisers will be reinspecting properties in Walnut, Eureka, South Homestead townships and the south half of Cheyenne and Logan townships. The towns of Albert and Olmitz and the Barton Hills subdivision will be included.

A portion of Great Bend will also be reviewed. This portion is located from Washington Street to the east city limits and 10th Street to the south city limits.

The Barton County Appraiser’s Office is mandated by K.S.A. 79-1476 to physically reinspect all real property in the county at least once every six years. The purpose of this inspection is to verify that the data is current and represents the property accurately.

The Appraiser’s Office physically inspects approximately 17% of the real property located in the county each year.

“Due to the current COVID-19 pandemic, our staff will be conducting reviews via vehicle only,” Esfeld said. “We will be reviewing the current data on file and updating photographs of all structures on file, but not knocking on doors.

“All vehicles utilized by our staff will be marked with the Barton County logo.

“It is not typical for our office to conduct interior inspections – unless requested by the owner – so we rely upon information provided by the owner/occupant,” she said. “Because we will not be conducting interviews at the door as in prior years, our office will be mailing questionnaires to each residence that is located within this year’s re-inspection area.”

Those who reside within the re-list area are asked to assist in their efforts by completing the questionnaire and returning it to the Appraiser’s Office office within 10 days.

Those with questions or concerns can call the Appraiser’s Office, 620-793-1821, or email appraiser@bartoncounty.org.

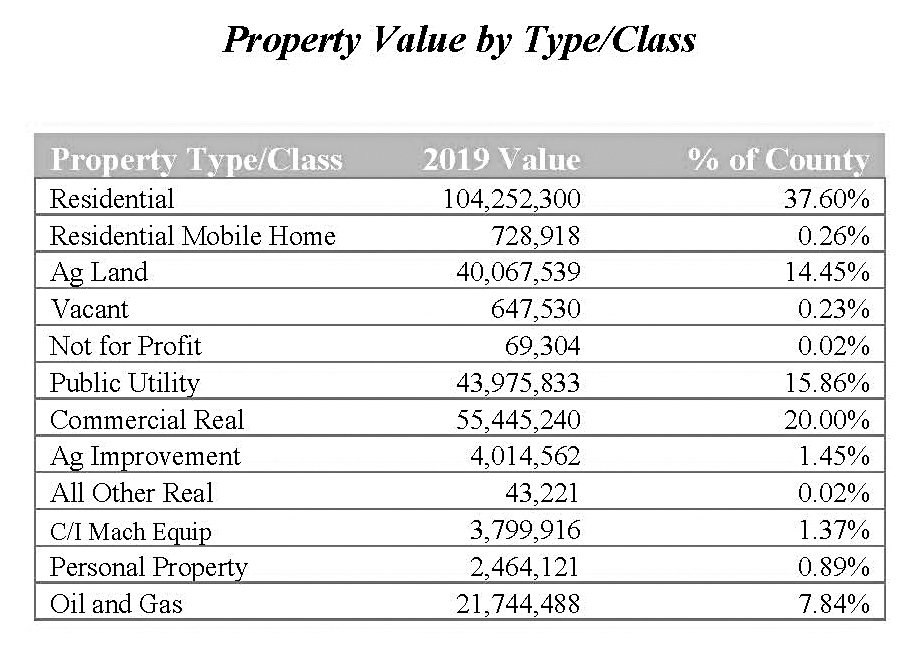

Be it fallout from the COVID-19 pandemic or some other cause, the result was the same – Barton County’s assessed oil valuation plummeted 51.7% year over year. That’s a decline of over $11 million in a county where oil accounts for 7.84% of the $277 million tax base.

“I took a punch in the gut when we put these numbers together,” County Appraiser Barb Esfeld said. The deadline to file the oil and gas property tax payments, known as renditions, was April 1 and Esfeld certified these totals with the county clerk this week.

Although there is not much natural gas produced in Barton County, it was up 27.25%.

Oil wasn’t the only blow to the county. Esfeld said. Although there were some bright spots such as boats and golf carts, personal property valuations fell 41.16% (this equates to about 0.89% of the tax base).

Also down were the state-assessed utility values which constituted 15.86% of the tax base in 2019. According to totals received by the County Clerk’s Office Monday, they fell from $43,975,833 in 2019 to $42,826,659 this year, a decline of 2.6%.

“These are the numbers the county will look at when they start setting the budget and mill levies,” Esfeld said. “It is going to be a tough year.”

Interestingly enough, she said real estate values were basically a wash, falling a mere 0.31%, or $635,000. Lasts spring’s flooding accounts for most of that loss.

Where’s the blame?

Back to oil, Esfeld said last year’s figures were based on oil being at $46 per barrel. This year, it is $23.

Some of that can be attributed to the pandemic and the decreased demand for oil as people traveled less. But, it may have its roots prior to COVID-19, she said.

This marks the worst tumble Esfeld has seen in her 35 years with county appraisals. But, she has seen past drops caused by other forces.

“We just don’t know for sure,” she said.

Barton County was not alone among oil-producing counties in take a hit. It fell 50% in Russell County and 54% in Ellis County.

By comparison

If oil makes up just under 8% of the county’s tax base and personal property less than 1%, what makes up the rest?

According to information provided by the Appraiser’s Office, residential properties are the biggest slice of the pie, valued at $104,252,300 in 2019, comprising 37.60% of the total. Commercial real estate comes in second, valued at $55,445,240, or 20.00%.

Others in the top four are agricultural land at $40,067,539 for 14.45%, and public utilities (mentioned above).

The balance comes from: Residential mobile homes, $728,918 (0.26%); vacant lots, $647,530, (0.23%); not for profits, $69,304, (0.02%); ag improvement, $4,014,562, (1.45%); all other real estate, $43,221 (0.02%); and commercial and industrial machinery and equipment, $3,799,916, (1.37%).