A recent study indicated Barton County residents, as a whole, ranked favorably financially.

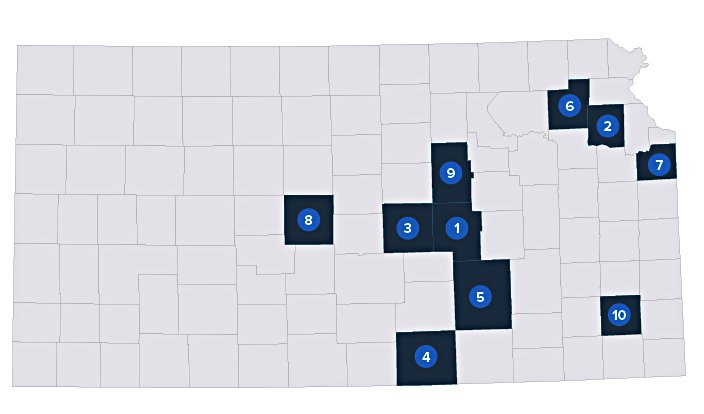

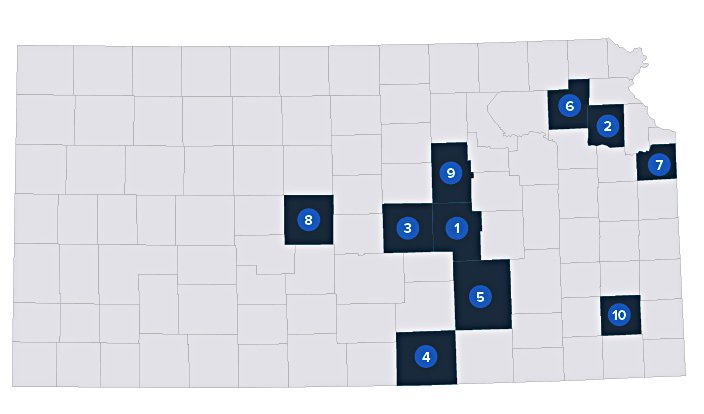

The financial technology company SmartAsset set out to find the places in the country where people have the highest net worth. Its study released last week measured net worth, income and debt across counties in the U.S. to see where people have the highest per capita net worth. Barton County ranked eighth among the top places in Kansas.

“At the local level, it appears that Barton County residents have generated wealth at a level favorable to both local income and debt, compared to Kansas as a whole,” said AJ Smith, SmartAsset’s vice president of financial education.

“These studies aim to get people thinking and talking about big financial decisions like planning for retirement or buying a home,” he said. “In this study we wanted people to get a look at wealth on a per-capita basis, so they can have an apples-to-apples comparison of how their county compares to neighboring counties and others throughout the state and country.”

By contrast, according to the U.S. Census Bureau’s QuickFacts, it has a poverty rate of 13.9 percent with a population of 26,476 and a median income of $44,449. Statewide, the rate is 11.9 percent with a population of 2,913,123 and a median income of $53,571.

This places Barton County in the middle of the pack out of 105 counties. Wyandotte County has the highest rate of poverty at 19.4 percent (population 165,288 and median income $40,757) and neighboring Johnson County had the lowest at 5.6 percent (population 591,178 and median income $78,186).

How do these two seemingly disparate figures reconcile?

“This study looked specifically at income, net worth and debt-per-capita in counties across the country; however, poverty rates were not included as part of the criteria,” Smith said. “This study shows that Barton County is on the high end for per-capita net worth compared to local income and debt, which helped it rank in the top 10 counties in Kansas.”

For its study, SmartAsset tapped into data from the U.S. Census Bureau 2016 American Community Survey, geographic information system supplier ESRI and the Federal Reserve Bank of New York.

“Our study aims to find the places in the United States where residents have the highest net worth,” Smith said. To do this, SmartAsset calculated the ratio of net worth to per capita income for every county.

“This number can serve as insight into how much people have saved or invested relative to their income level,” he said.

It also calculated the ratio of net worth to debt per capita for each county. This measure incorporates a view of a county’s debt burden relative to net worth.

Lastly, the study indexed each factor and calculated an overall index by taking a weighted average of each of these indices. The net worth to income index was given a weight of two and the net worth to debt index was given a weight of one.