Overall, Barton County is looking at an increase in valuation of around 4.07%, at least for now, County Appraiser Wendy Prosser said, giving a report to the County Commission Wednesday morning.

But, “this is very preliminary,” she said. “We still have some properties that we are working on the valuations for.”

After the valuations come out, there will be hearings and there may be some adjustments, she said. The increases may wind up being higher or lower.

“I know there are spots in Great Bend where we did see some decrease in values,” she said. “It just depends on the area that you’re in.”

Regardless, District 5 Commissioner Jennifer Schartz appreciated the information.

“I think this gives us a heads up when we start the budget process,” she said. In a time of inflation, money is tighter for taxpayers and the commissioners don’t want to make the burden harder on them.

It’s a matter of being fair with property values and keeping an eye of the mill levy, she said. “It’s just a tough, tough thing all the way around.”

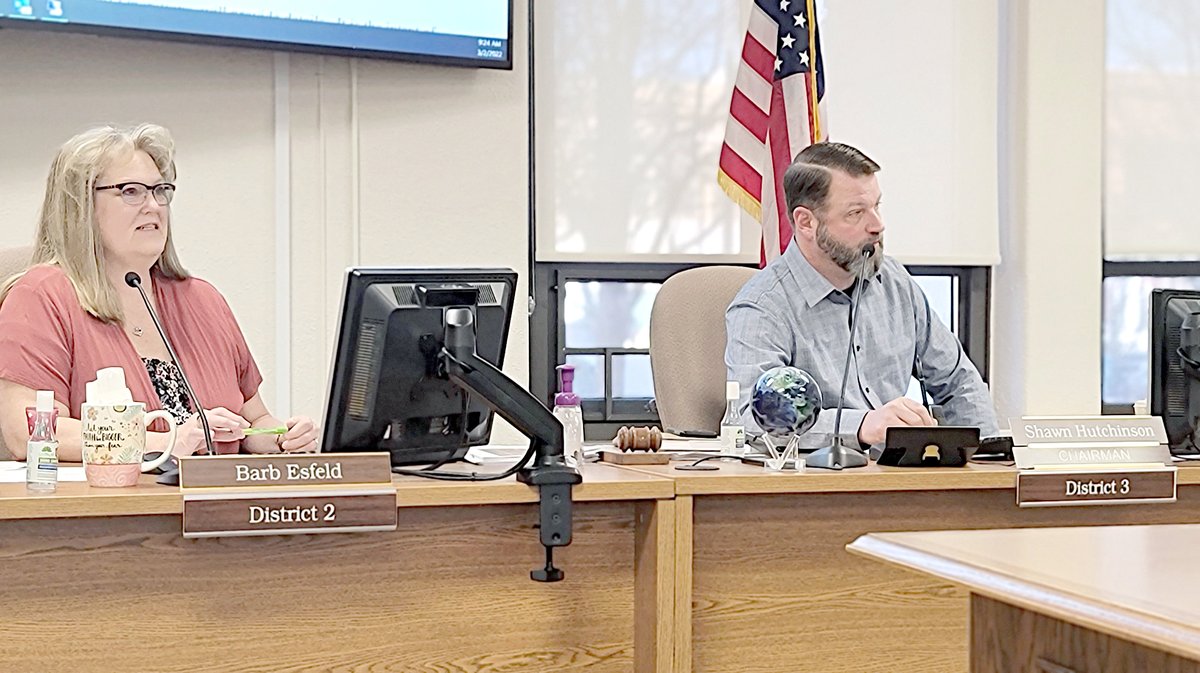

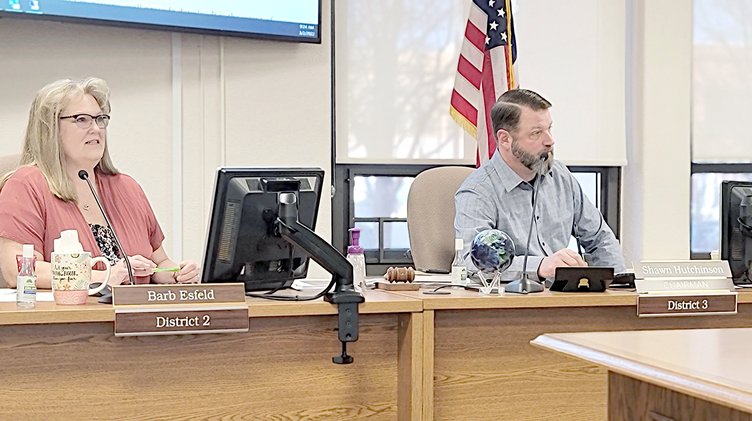

District 2 Commissioner Barb Esfeld said the commission will set up meetings with all the department heads to discuss these issues. It’s going to take every official and taxing entity being mindful of the tax rate.

“To try to protect people and keep them from being taxed out of their home, it’s going to take all of us to work together,” Esfeld said.

When setting values, “we are supposed to be within 10% of what it would sell for on the market,” she said. The crazy real estate market shows up in their figures as well.

“The point of valuing properties in Kansas for taxation purposes is to allow each property owner to pay their fair share of the overall taxes needed to fulfill the budgets of the taxing districts,” Prosser said. “Our job in the appraiser’s office is to figure out who owes what.”

A crazy year

Prosser said she will have an actual market comparison sheet when they get the valuations sent out.

“Our office is in the process of finalizing our property values for the 2022 valuation year,” Prosser said. By state statute, they’re to notify the taxpayers or property owners of real estate by March 1.

However, they can get an extension from the Kansas Department of Revenue Property Valuation Division, she said. Her office was granted an extension until March 15 “due to the crazy market and inflation.”

However, “we are taking diligent time and looking at those values and making sure that we are fair and accurate with everybody,” she said. In light of this, they were granted a second extension until March 23.

“So property owners have 30 days from that date to call and request an informal hearing,” Prosser said. These visits can be in-person or over the phone.

Breaking it down

She then ran though some appraisal numbers as of Tuesday:

• On residential property, they’re seeing about an 8.24% increase in values.

• For farmsteads with homes, they’re seeing a 3.68% increase.

• On agricultural land, there was a reduction of 2.76%. These are not based on local market values, but instead on state formula factoring an eight-year rolling average of land-use value.

• On ag buildings, because of the cost of materials, they’re seeing an increase of 3.97%.

• On commercial/industrial property, they’re seeing about a 1.62% increase.

• Due to buildings being torn down in preparation for new construction, there is an increase in the number of vacant lots, she said. “So we’re seeing our land values really increasing, which is a good thing.”

• Her office is seeing about a 29.19% increase in land values. But, if a $1,000 vacant lot jumps to $2,000, that’s a huge increase, and this can skew the overall numbers.

• Not-for-profits are showing a 5.49% increase. These include the Columbus Club and Elks Lodge, which are assessed at a lower rate but are still taxed.

• Even though the exempt non-profits don’t generate tax dollars, her office values them as if they’re on the tax rolls. They are seeing a 2.31% increase.

• Another unknown is the price of oil, Prosser said. The Kansas Department of Revenue Property Valuation Division has a team that looks at trends and forecasts what the average price per barrel will be for the upcoming year.

That value is then used by counties for valuation purposes, she said. The value set at the beginning of the year is the one used for the rest of the year, regardless of whether the price of oil goes up or down.

It was $30 last year and $60 this year, despite the price of oil being over $100.