Keeping your home warm this winter is going to cost Golden Belt residents, Kansans, and the rest of the country, more money based on escalating fuel costs, below average national storage reserves and cold weather on the way. The uptick in prices is taking place internationally as well.

This according to the Kansas Corporation Commission, which on Tuesday approved a settlement with Kansas Gas Service.

The agreement allows KGS to recover $366 million in deferred natural gas costs incurred during last February’s winter weather event over time, using low interest bonds.

But, “the utility, like others regulated by the KCC, was ordered to do everything possible to continue providing natural gas service to its customers, defer the charges, and then develop a plan to allow customers to pay the unusually high costs over time to minimize the financial impact,” according to a KCC news release.

Although final calculations are yet to come, the KCC estimates customers will see their monthly bills range anywhere from $5 to $7 higher per month for a period of 5-10 years.

“Kansas Gas Service is pleased with the order from the Kansas Corporation Commission ... to recover costs from the February 2021 winter storm,” a statement for KGS reads. “We prioritize keeping our customers safe and warm during these extreme weather events and aim to recover the unprecedented costs from the high natural gas prices due to the storm with fairness and minimal impact to customers.”

Under the terms of the agreement, KGS will apply for Securitized Utility Tariff Bonds to obtain the most favorable financing to reduce costs to ratepayers. The 2021 Kansas Legislature passed the Utility Financing and Securitization Act, which allows utilities to use securitized bonds to pay for extraordinary costs at more favorable terms than traditional financing.

The KCC will review the plan to ensure the lowest possible bond costs will be passed on to customers. The application and review process could take six to eight months.

In the public interest

The Commission emphasized it was in the public interest for KGS to incur the extraordinary costs to ensure the integrity of the gas system and ensure continuous service to its customers.

“A lesser response could have resulted in catastrophic property damage and serious public safety implications, including potential loss of life,” the commission’s news release continued. “When extraordinary costs are unavoidable and necessary to benefit the public, it is in the public interest to allow recovery of such costs.”

Tuesday’s order states any proceeds received by KGS from ongoing federal or state investigations into market manipulation, price gouging or civil suits will be passed on to customers. In addition, KGS has agreed to file a plan to assist low-income customers in its service territory by Dec. 31, 2022.

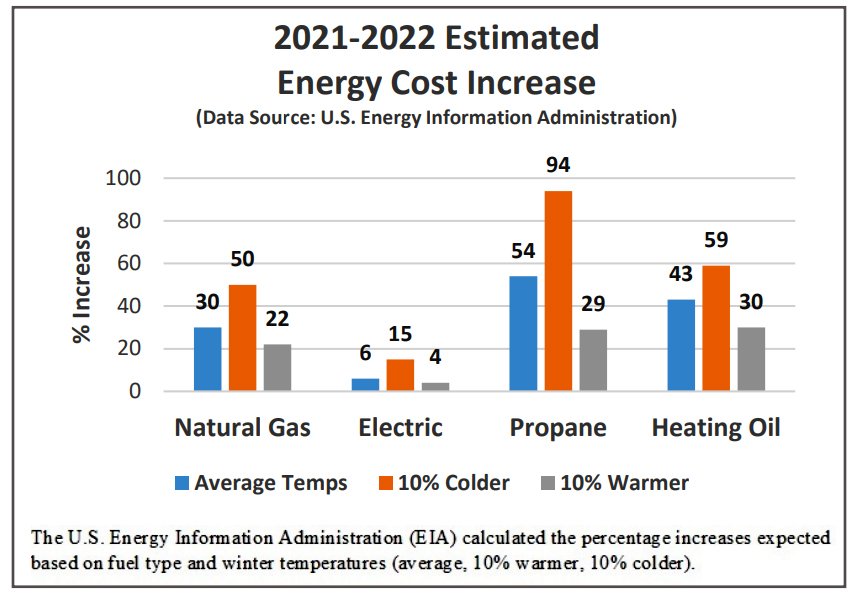

On average, natural gas costs are projected to rise by 30% and electric costs by 6% nationally. Half of U.S. households heat their homes with natural gas. Forty-one percent use electricity, which is sometimes generated by natural gas.

Alternate fuel sources, used to heat 9% of homes, will cost more as well. Propane prices are expected to rise 54% on average with heating oil trending up 43%.

How we got here

The U.S. Congress deregulated natural gas prices in the mid 1980’s. As a result, prices are driven by the market, the KCC noted.

The cost utilities pay for energy is a direct pass through to its customers. Utilities do negotiate contracts with their suppliers and utilize hedging and storage to help manage costs, but overall, supply and demand plays a huge role in market prices, according to the KCC website.

Natural gas storage levels have been below five-year average levels all summer and that continues, according to the KCC. Coming out of Winter Storm Uri in February 2021, the nation’s storage levels for natural gas were significantly depleted.

This storage has been slow to refill for a variety of reasons:

• Natural gas is used as a fuel for electric generation. Demand has been higher than average due to heat waves in the west and southern parts of the U.S. Plus, there was a need to replace hydroelectric production in the west due to record drought.

• Energy shortages in Europe and Asia are fueling exports, which displaces production that might otherwise go to domestic storage and other uses.

• Domestic production of natural gas has declined recently as offshore natural gas wells were disrupted from Hurricane Ida and extremely low energy prices during the pandemic caused shutdowns in domestic oil and gas wells.

• U.S. producers are exporting record amounts of natural gas to Mexico, up 25% from a year earlier and 44% more than the previous five-year average.

The KCC reported yet another factor that could affect supply is the arrival of winter weather, which will increase demand and lead to higher prices. How much will vary depending on where one lives.