Great Bend City Council meeting at a glance

Here is a quick look at what the Great Bend City Council did Monday night:

• Held a study session to discuss retirement plan options for public safety personnel.

Present were representatives of Mission Square, the current provider of the city’s retirement package.

• Set a public hearing for property at 1210 Morton Street for 6:30 p.m. Monday, Sept. 7. The garage there has been inspected by the Code Enforcement Department and the building inspector. They have determined that the structure is unsafe and dangerous, code enforcement officer Art Keffer said.

• Set a public hearing for property at 1923 Holland for 6:30 p.m. Monday, Sept. 7. It has also been inspected by the Code Enforcement Department and the building inspector. They have determined that the structure is unsafe and dangerous as well, Keffer said.

• Continued a public hearing for an unsafe and dangerous structure at 2555 19th St. until Monday, Sept. 7.

The garage located at the southwest corner of the property at 2555 19th St. (19th and Washington) has been inspected by the Code Enforcement Department and the building inspector. They have determined that the structure is unsafe and dangerous.

By resolution, the council set a public hearing for Monday night to allow any owner, agent lienholder or occupant to appear and show cause why the structure should not be removed.

That resolution was mailed and published. The owner, Michael Whithorn, sent a letter stating that he will be unable to appear because he is in is in jail in Arkansas, said City Attorney Allen Glendenning. He expects to be out of jail in early January and states that he has already obtained financing to repair the garage as well make other repairs and improvements on the property.

He said he intends to start the work in the spring of 2022.

• Approved 2021 non-budgeted transfers in the amount of $1 ,538,964.95. These transfers also include monies received from donations and insurance proceeds, City Clerk/Finance Director Shawn a Schafer said.

• Authorized Mayor Cody Schmidt to sign a lease for Hangar 3 at Great Bend Municipal Airport. Bids for the city-owned were advertised with a bid deadline of Oct. 20. The highest bidder was Med-Trans Corporation, with a bid of $1,200 per month, Airport Manager Martin Miller said.

This is a five-year lease starting Jan. 2, 2022.

• Approved the bid from Roofmasters Roofing and Sheet Metal for $71,148 for the repairs to the roof at the Sports Complex.

The metal roofs at the complex were damaged during the past windstorms. Insurance proceeds will cover the bid, Public Lands

Director Scott Keeler said.

• Approved signing a waiver of claims and joining the national opioid settlement.

Kansas is a part of the multi-state litigation aimed at holding the producers and distributors of opioids accountable for the negative effects

that their drugs have had on the American public. In 2021, the Kansas Legislature passed the Kansas Fights Addiction Act to govern how

funds from opioid settlements would be distributed in the state, City Administrator Kendal Francis said.

Pursuant to the bill, the state will receive 75% of the settlement with local governments divvying up 25% of the funds. As required by the bill, the League of Kansas Municipalities, the Kansas Association of Counties, and the Attorney General’s office are finalizing a memorandum of understanding to govern the administration and split of the local portion.

In order to receive settlement funds, the city will need to certify previous or expected costs to the city of at least $500, agree to spend any settlement funds for lawful purposes, and waive any remaining claims related to the opioid litigation.

• Held a discussion on the city’s master fee schedule.

The City’s executive team desires to implement an annual review of all fees that the city charges to ensure that they remain current and relevant. Currently, those fees are disbursed throughout the Code of Ordinances, obscuring them, and significantly hampering the team’s ability to adequately review them, City Administrator Kendal Francis said. Best practice is to compile all fees into a master fee schedule resolution, which allows for ease of review and adjustment.

No decisions were made Monday. More discussions will follow and there may a work session on the topic.

• Heard a report from City Administrator Kendal Francis.

• Heard a report from Community Coordinator/Convention and Visitors Bureau Director Christina Hayes.

• Approved Abatements for trash and refuse at: 3324 Lakin Ave., Thomas Pearson; 1203 Madison St., Dorsha R. Ratledge

217 Pine St., Gladys Chism; 224 Maple St., Angelica Rincon; 509 Odell St., Brian Eugene Jonas; 2501 Lakin Ave., Keith Heeke; 3410 Lakin Ave., Carolyn Stacey Farris; 2536 8th St., Mark A Shaffer; 720 Morphy St., Quincy Stahl; 1400 8th St., Daniel L Scott; 1408 11th St., Jesus M Rivera Araiza; 1206 Frey St., Byron Clawson; 205 Frey St., Miguel A. Garay; 1610 Morton St., Moses Properties LLC.; and 212 Chestnut St., Sandra Alarcon.

• Approved abatements for motor vehicle nuisance at: 1211 Morton St., Jose Andrade; 205 Frey St., Miguel Garay; 215 Hubbard St., Jesus Olave; 1421 8Th St., John Love; 1439 16Th St., Brett A. Terry; 2704 16Th St., Kristie Zenner; 1036 Jefferson St., Michelle Grisby; and 1114 Holland St., Stanley A. Kreigh.

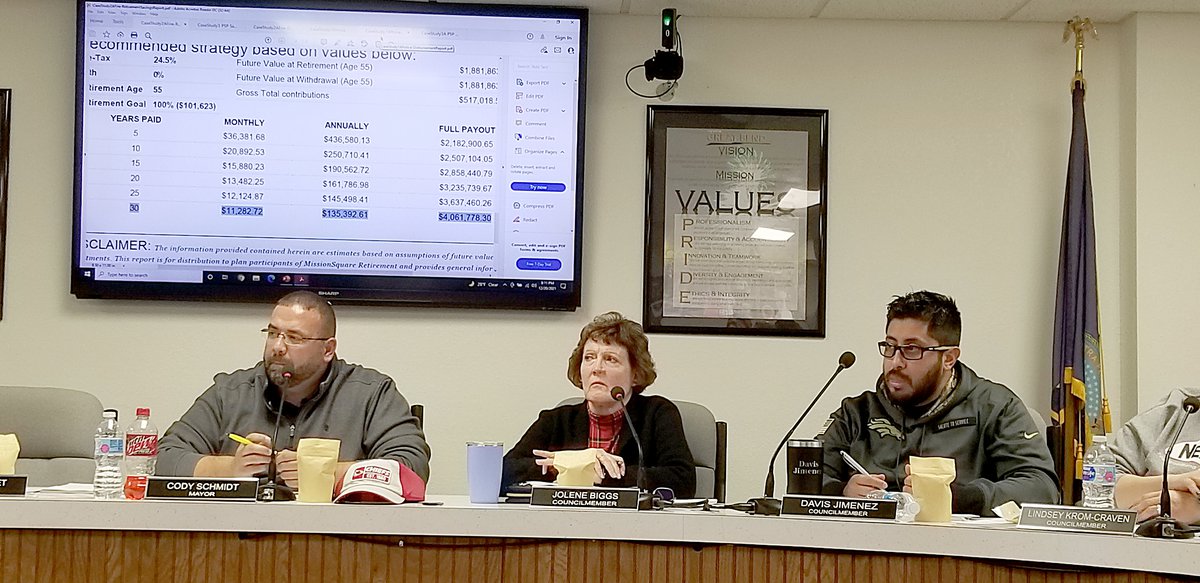

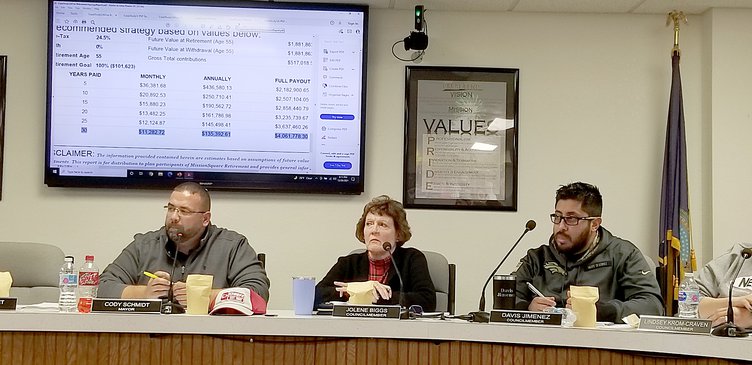

After the November general election approval of a .20% sales tax for public safety personnel pensions, the Great Bend City Council held its first study session on the topic Dec. 6. This started initial discussions on what changes to Police and Fire departments retirement plans may look like.

In the second work session on the topic, council members Monday night looked at the second of two options, staying with the existing retirement plan.

“We need to decide which way we want to go,” said Ward 2 Councilwoman Jolene Biggs. But, she and others on the governing body noted they didn’t want to rush into this.

“I’m in no hurry,” Mayor Cody Schmidt said. Now that the sales tax has passed, “it is our job to listen (to staff and the public) on how we’re going to spend you guys’ money.”

Currently, the city provides a 401A retirement plan for all employees (like a 401K), including policemen and firefighters. However, first responder retirement needs are unique, with more limitations on how long they can work, city officials said.

So, to improve this, the city sought the sales tax. This comes to 20 cents on every $100 spent, raising an estimated $755,000 each year with no sunset.

The present plans are with Mission Square Retirement, a national, Washington, D.C.-based non-profit corporation providing public sector retirement plans. The city is not a part of the Kansas Public Employees Retirement System.

Present Monday were Denise Crawford from the Kansas City area and Roy Combs from St. Louis, both with Mission Square. They went over various scenarios for local police and fire retirees.

They said a profit sharing option could be added, tapping the tax money to fund it. The tax could also be used to cover the cost of long-term disability insurance for uniformed personnel.

However, there were several police officers and firefighters present. They expressed concerns over the current system.

At the previous study session, the council looked at the switch to the Kansas Public Employee Retirement System’s Kansas Police and Fire plan.

This is passionately supported by officers and firefighters who see it as offering a better post-service lifestyle and a recruitment tool, but some city officials worry about its long-term cost.

A large number of safety staff were present at the first session, several of whom offered emotional testimony in favor of the switch.

Monday night, comments from the safety personnel noted they have feel “gun shy” about sticking with Mission Square and they “have felt abused” by the current plan. They also recounted examples of retirees who ran out of their retirement funds too early.

There is no timeline to make a decision, City Administrator Kendal Francis said. Should the city move to KF&F, that wouldn’t happen until January 2023.

Although Kansas Police and Fire falls under the KPERS umbrella and the city is not affiliated with KPERS, it can still go with KP&F for first responders. But, it would be exclusively for them (it would not cover GBPD or GBFD office staff), and once the change is made, there is no going back.

There was some concern among council members about KPERS not being fully funded, and the long-term viability of KP&F and its cost to the city.

Some on the council were also concerned about what would happen if an employee leaves before being fully vested and is not eligible for KP&F benefits. The city pays into the trust fund for that person, but would not be refunded any of the money it invested.

They fear potential ramifications for taxpayers.

Police officers and firefighters say this would make the departments more competitive and help eliminate the rapid turnover that plagues both. It also offers a guaranteed pension for retirees, something not addressed by staying with Mission Square.